How the Pandemic has Changed Drinking Culture in America

The Coronavirus pandemic has fundamentally altered the way we live, interact and prioritize our lives. However many, while acknowledging the tragic toll the pandemic left behind, will attribute the time as a catalyst for positive change and personal growth. One such change is the shift occurring around drinking culture. Attributable to a multitude of factors from personal health awareness to the expansion of health-tracking wearable devices and societal changes as a whole, a no-alcohol mindset and market has emerged in the last few years and contributed to a new, more mindful drinking culture.

How Americans Consumed Alcohol Entering the Pandemic

Contrary to popular belief, the United States is far from a world leader in alcohol usage. In fact, the United States is quite far from its European counterparts in terms of alcohol consumption per person. Some research has shown intoxication rates are higher than those reported in the United States in about half of the countries in Europe. That’s not to say alcohol isn’t playing a large role in American culture. 54% of respondents in one domestic study reported casually drinking while 26% of respondents admitted to binge drinking during the same time period.

Seen below, changes in the ways Americans consume their liquor evolved as new product lines and shifts towards hard seltzers began to materialize near the tail end of the past decade. At the same time, growth rates in alcohol consumption have been steadily falling as of late since the 1980s and 1990s.

The Pandemic Effect:

Habits in alcohol consumption were fundamentally altered during the pandemic. The initial shock and despairing news from the pandemic did enough to offset the loss of sales from the closure of bars, as Nielsen reported a 54% increase in alcohol sales in the initial week of pandemic madness in March of 2020. Through the onset of the pandemic, trends followed the same direction. Another report found that American adults reported drinking 14% more often which coincided with a 41% spike in heavy drinking among women. Besides the initial shock and melancholy of the pandemic, alcohol trends were further exacerbated by those using alcohol as a stress-coping mechanism. In a study conducted by the American Psychological Association, nearly half of parents reported higher stress levels during the pandemic while nearly 1 in 4 adults reported drinking more to cope with pandemic-related stress.

A silver lining? As the pandemic progressed, consumers sought new experiences and broadened their tastes. This exploration met the increasing focus on personal health coming out of the pandemic and contributed to the rise of a new trend: The Sober Curious Movement.

What is Sober Curious?

Coined by Ruby Warrington, author of the 2018 book “Sober Curious: The Blissful Sleep, Greater Focus, Limitless Presence, and Deep Connection Awaiting Us All on the Other Side of Alcohol,” Sober Curiosity implies the avoidance of alcohol for personal or wellness reasons. While the health benefits of reducing alcohol intake are widely agreed upon, the movement isn’t necessarily completely health-driven. Some have joined the movement after examining the role alcohol plays in their lives and how an alcohol-free lifestyle differs in social contexts.

The makeup of the movement coincides with those reported to be most affected coming out of the pandemic: the millennial and Gen Z age group. With less ingrained drinking habits and a greater openness to change than their parents’ generation, the younger population is driving the new market. According to Nielsen, nonalcoholic beer sales went up 44% in the U.S. YoY. Looking back to 2015, the no- and low-ABV sector has grown over 500% while non-alcoholic spirit brands launched both domestically and abroad. Google search results for Dry January were up 25% in the US, and 10% globally between 2019 and 2020. Searches of “Sober Curious” on the other hand saw major spikes during the pandemic as can be seen below.

While the market has buoyed coming out of the pandemic, it’s important to note the United States certainly isn’t the first mover as regions in Europe and Australia have been quicker to search and adopt the idea of a lower alcohol lifestyle. One report claimed consumption has decreased over the past 15 years in Australia. However, as always, things tend to move quickly in exciting spaces. Consumption of no and low alcohol is expected to grow 31% by 2024.

The Zero-Proof Model

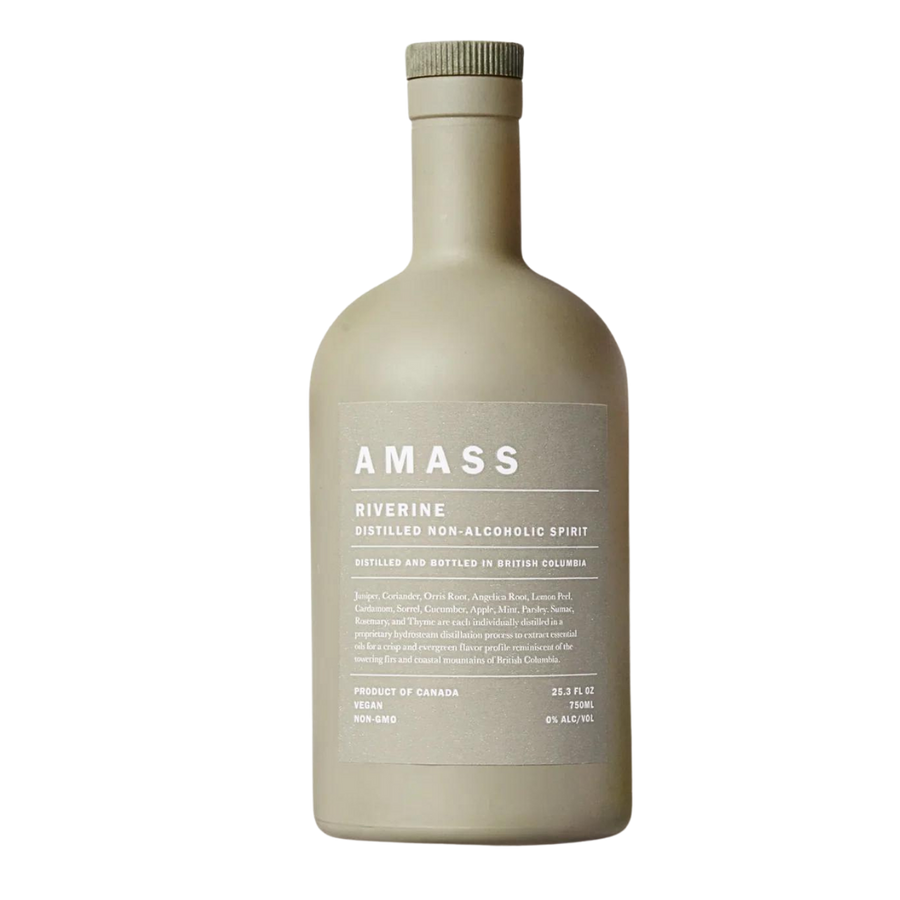

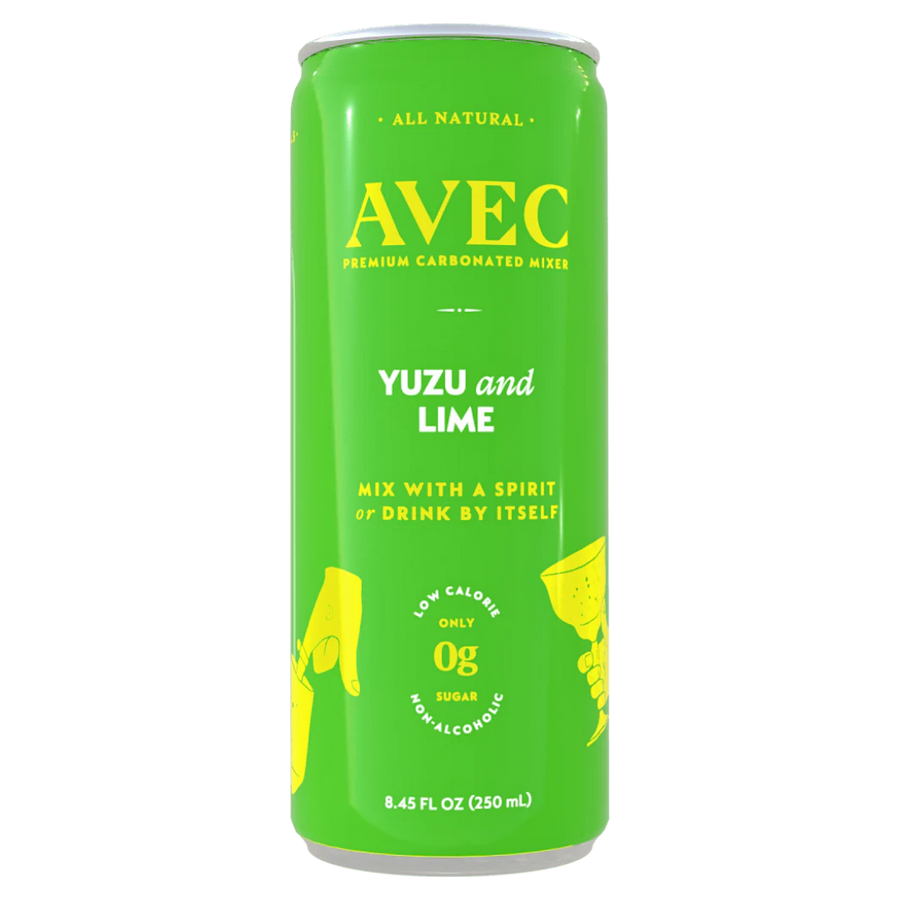

The integration and use cases of sober curious lifestyles and non-alcoholic trends as a whole are highly replicable. In 2013, Ben Branson experimented and came up with the world's first botanical based, non-alcoholic spirit. The spirit, Seedlip Spice 94, was introduced in 2015 and has been a staple of non-alcoholic cocktails since. The non-alcoholic cocktail has grown in popularity and can many times be made to taste just like the local bar favorite. In addition, interesting new ingredients such as aquafaba (chickpea water) are being introduced to create refreshing drinks for the growing consumer base. Both alcohol-free and traditional bars are keen to capitalize on the zero-proof cocktail trend. Besides the data showing a growing interest, these drinks are often sold at attractive margins. Most non-alcoholic beverage sales tend to be in the soft drink category and relatively inexpensive. Bars that curate new and intriguing zero-proof cocktails can set higher price points, similar to those of cocktails with alcohol, while expanding their customer base.

Additionally, as evidenced by recent funding rounds, non-alcoholic trends aren’t expected to slow down anytime soon. Stars turned investors such as JJ Watt and Justin Tuck are just two of the endorsers aiming to bring alcohol-free brands like Athletic Brewing to mainstream culture, and for good reason too. 58% of consumers are drinking more non-alcoholic beverages than last year. Some estimate the alternative market to exceed $29 billion by 2026.

Looking Forward

It’s our belief that the future of drinking culture lies at the intersection of historical norms and newer alcohol-free lifestyles. As of today, consumers can purchase non-alcoholic spirits via many of their favorite distributors or through a rapidly growing modern e-commerce focused landscape. Platforms like A Fresh Sip simplify the discovery and purchasing process of non-alcoholic beverage brands for consumers. The pace of innovation in the alcohol-free market, much like any new market, is rapidly progressing. Brands like TÖST, an elevated non-alcoholic sparkling tea brand, and the alcohol-free spirit brand Lyres are just a few of the companies launching new products in the rapidly growing market. Add the fact that celebrity influencers such as Blake Lively and Bella Hadid are not only marketing the space, but joining and creating within it as well and the momentum is easy to see.

Above all, it’s the community behind these brands and shifts that create such strong tailwinds for the industry. There are infinite reasons consumers may decide to decrease or eliminate their alcohol consumption. The core of this culture shift is a desire to merge the two lifestyles, not ostracize one or the other. Ultimately, current events continue to show that a more inclusive drinking environment is good for consumers, good for suppliers, and just good business.

A Fresh Sip (AFS) is an alcohol-free beverage platform that simplifies the process of discovering and shopping non-alcoholic options nationwide. AFS offers 250+ non-alcoholic beers, wines, spirits and other functional beverages tailored to personal needs and lifestyle preferences (ie. vegan, gluten-free, pregnancy-friendly). Driven by community, AFS is on a mission to reshape drinking and normalize “not drinking”.